1-Sentence-Summary: The Algebra of Wealth is a college professor and serial entrepreneur’s personal formula for achieving financial freedom based on focus, Stoicism, time, and diversification, which will help you eliminate economic anxiety through a combination of well-paid work, diversified investments, and good financial habits.

Read in: 4 minutes

Favorite quote from the author:

Table of Contents

Video Summary

What happens when an MBA student walks into class an hour late on the first day? If the professor is Scott Galloway, not only will he be sent packing, he’ll also become the subject of a viral email exchange.

The first time I read “Prof G’s” name, as the Professor of Marketing at NYU’s business school calls himself, was when said emails were all over the news. The student complained to Galloway that he was sampling 3 classes and couldn’t have known about his “only-15-minutes” late policy.

“Get your shit together,” Galloway responded in a mini-essay now dubbed “Getting the Easy Stuff Right.” “There is a baseline level of decorum (i.e., manners) that we expect of tomorrow’s business leaders,” he wrote — and showing up late to 3 classes in one night wasn’t it.

“Getting a good job, working long hours, keeping your skills relevant, navigating the politics of an organization, finding a work/life balance … these are all really hard,” Galloway told the student. “In contrast, respecting institutions, having manners, demonstrating a level of humility… these are all (relatively) easy. Get the easy stuff right.”

With the same mix of tough love and realism, Galloway delivers his weekly column “No Mercy / No Malice.” It first led to his book The Algebra of Happiness and now The Algebra of Wealth. The latter is Galloway’s template for financial security, which he has achieved through education, writing, and 9 founded companies.

Here are 3 lessons from the book to help you achieve financial freedom:

- Being wealthy really comes down to economic security, nothing more.

- The algebra of wealth goes back to a 4-part formula: Focus + (Stoicism x Time x Diversification).

- After a lifetime of investing, Galloway has learned 4 big lessons.

Let’s discover the algebra of wealth!

The Algebra of Wealth Summary

Lesson 1: Wealth is the absence of economic anxiety.

Professor Galloway hates skiing but goes every year. It’s an excuse to spend time with his family. One night, his 11-year-old son walked in, crying. “I lost a glove. Mommy just bought me these. They cost 80 €. That’s a lot of money.”

Trying to console him, Galloway found himself looking for a glove in the freezing cold — and remembered when he was 9 in the early 1970s. “After my folks separated, economic stress turned to economic anxiety. Anxiety gnawed at my mom and me, whispering in our ears that we weren’t valid, that we’d failed.”

When he lost not one but two jackets in a row one winter, the young Scott was devastated, knowing how much financial strain he had caused. “Economic anxiety is high blood pressure,” he writes, “always there, waiting to turn a minor ailment into a life-threatening disease.”

Galloway eventually made it to the point where he could comfortably afford not just to replace a pair of gloves but even to take care of his mother at home when she got cancer. However, his poverty-stricken childhood left him with a healthy perspective on money: “Wealth is a means to an end: economic security. Put another way, wealth is the absence of economic anxiety. Freed of the pressure to earn, we can choose how we live.”

That’s what wealth is truly about. Anything more is a bonus — like finding your kid’s lost skiing glove, which, thankfully, Scott and his son also did that night.

Lesson 2: The formula to build wealth consists of 4 parts: focus, Stoicism, time, and diversification.

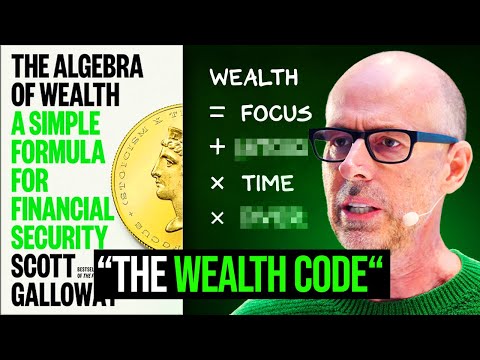

Galloway’s “algebra of wealth,” as he calls his formula, is a simple, 4-part equation: Wealth = Focus + (Stoicism x Time x Diversification).

- Focus is “primarily about earning an income — and you’re going to need a decent amount of it,” Galloway writes. You should follow your talent more so than your passion and increase your earning potential where you can.

- Stoicism is ” about living an intentional, temperate life in and out of work.” Saving money is important, yes, but it’s also about being part of a community and strengthening your character.

- Time is “the real currency, the one asset we’re all given at birth.” Remember that now is the time to start acting. Today is the youngest you’ll ever be, and compounding takes time. Every extra day counts.

- Diversification is about knowing the markets, the basics of investing, and then making a few sound choices consistently.

In a nutshell, Galloway’s formula suggests that whatever money you generate plus your investing choices times your discipline times the compounding effect equals your level of wealth.

Everyone needs time to get going on the income bit. But after a few years in the working world, more and more, your wealth will be determined by your choices, your habits, and your time in the market.

Focus on these elements, and you’ll do just fine in the long run.

Lesson 3: Galloway has learned 4 big lessons from a lifetime of investing.

While we can’t fit Scott’s entire Personal Finance 101 class into this summary, we can share some unique tips that stood out to me. Towards the end of the book, Galloway offers 4 big lessons learned from many decades of investing:

- Zig when others zag. Don’t chase the shiny thing everyone else is chasing. By the time dog coins, NFTs, or AI stocks are popular, most of the growth has already happened — and the decline is surely soon to follow. The same applies to other investments like college degrees. There was a time when they always had an ROI, but now, many of them are too expensive.

- Don’t trust your emotions. How risky your investments are should depend on how much volatility you can stomach. Analyze your mistakes in depth, and remember to take money off the table every now and then.

- Don’t day-trade. “It’s gambling, but with worse odds and no free drinks,” Galloway writes. He quotes a study that found only 3% of active retail traders made money over a 2-year period. Gamble with a small part of your portfolio if you want to, but don’t go overboard.

- Move. Where you live has significant consequences, both economical and personal. But location-arbitrage is real. Consider moving to a lower-tax location, and keep an open mind about this throughout your life.

There you have it. Building your financial life right can take a long time — but as long as you remember the algebra of wealth, sooner or later, you’ll get there!

The Algebra of Wealth Review

The Algebra of Wealth is a useful collection of Scott Galloway’s best money advice, of which he has plenty. Always told in story-form with plenty of dry humor, this book will both make you chuckle and go “Aha!” in every chapter. Awesome!

Who would I recommend our The Algebra of Wealth summary to?

The 19-year-old college major who learned nothing about personal finance in school, the 35-year-old successful startup founder who hasn’t liquidated any of his stock, and anyone who feels like they should have “made it” by now.

Last Updated on May 6, 2024