1-Sentence-Summary: I Will Teach You To Be Rich helps you save money on autopilot while allowing yourself to spend guilt-free on the things you enjoy.

Read in: 4 minutes

Favorite quote from the author:

Table of Contents

Video Summary

Ramit Sethi has turned from a geeky little Indian kid into one of the major personal finance gurus of the 21st century. What started as a blog in 2004 has become a multi-million dollar empire, selling courses and classes for tens of thousands of dollars a piece – all via email.

I got I Will Teach You To Be Rich for Christmas last year, and liked his funny, sarcastic writing style along with his no-BS tips. I re-read the summary on Blinkist today, and want to share 3 major learnings with you:

- You’re the only one responsible for your financial problems.

- Know how much money you have coming in and then automatically direct it where you want it to end up.

- Start investing today, even if it’s just $1.

Let’s go!

I Will Teach You To Be Rich Summary

Lesson 1: Start taking responsibility for your money

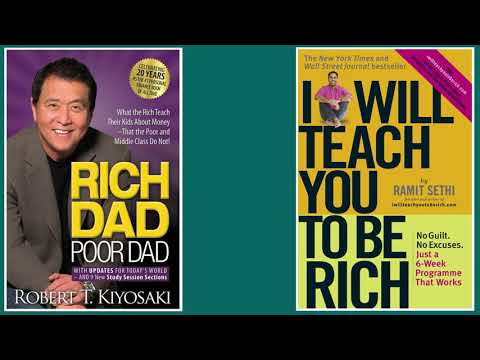

Much like Rich Dad Poor Dad, this book starts with a necessary reminder to start accepting you’re the one in the cockpit, when it comes to your money.

Most people agree that they “should exercise more” or are “supposed to eat less junk food”. Even if they can’t make the change, at least the insight’s there. But have you ever heard anyone say: “I really need to get better at handling my money.”?

Rarely.

Because no one likes to admit that they’re bad with money. Even though a lot of people are.

Yes, there are plenty of people and factors to blame. Like the media, confusing you with all this contradictory information. Or the education system, which never taught you how to spend your money, save it, let alone invest it.

But excuses will always stay what they are: excuses. No matter how right they might be.

Saving and investing money is scary, and you might lose some money, but better to lose it now, rather than tomorrow. The younger you are, the more risk you should take on, because it’s still easy for you to make back the money.

And even though it will take a while to see results, if you can only afford to invest a little, you should never neglect the power of compounding interest.

So stop making excuses, and start taking responsibility for your personal finances. It’s the first step towards getting rich.

Lesson 2: Take fixed cuts off your paycheck and automatically spend them towards your goals

Sitting down every month to see how much you want to spend on what is a hassle. No one wants to do that.

Which is why Ramit suggests a Conscious Spending Plan. What he means by that is: Take cuts off your paycheck and automatically spend them towards the right things.

For example: Use 60% of your income to pay fixed costs, like rent, utilities, food and your credit card bill. Then, invest 10%, for example in stocks, your 401(k), or Roth IRA. Save another 10% for vacations, Christmas presents and unexpected costs.

This leaves you with 20% of your money, which you can spend on whatever you like, guilt-free.

Automate these processes and payments, for example I personally save $50 every month, which is automatically taken out of my bank account on the 1st.

This way I make sure I save at least $600 per year, and there’s no chance I’m spending that money accidentally.

As with any habit, removing the need for willpower makes it a lot easier to get it right.

Lesson 3: Start investing today. No joke.

Investing is hard. You have to read books, talk to people, and educate yourself. But you will regret every single day you waited to start doing it once you’re old.

Why? I found a great example, that puts it in numbers.

If you invest $5,000 every year (which is $417/month) for 10 years, from age 25 to age 35 and then never invest again, you’d still have more money at retirement, than someone who starts at age 35 and invests $5,000 every year UNTIL they retire.

The 25 year old starter invests $55,000 and ends up with $615,000 (given an 8% annual return, which is close to the average return of the stock market per year). The 35 year old invests $130,000 and ends up with $431,000.

Do you realize how insane that is? You can invest less than half and end up with one and a half times as much money!

Just by starting 10 years earlier.

So yeah, you better start today.

I Will Teach You To Be Rich suggests maxing out your 401(k) to get the maximum from your employer (they will usually match your contribution, up to a certain point) and then also investing in a Roth IRA, another form of retirement plan, but one that you control, and lifecycle funds, which invest your money automatically, shifting from riskier to safer investments as you age.

Soon after I read Money – Master The Game by Tony Robbins, which recommended index funds. James Altucher likes stocks and cash.It’s complicated. No arguments there. Which brings me right back to lesson 1.

Start taking responsibility and act today.

I Will Teach You To Be Rich Review

Rich Dad Poor Dad teaches you the investor mindset, once you’re ready to invest. I Will Teach You To Be Rich teaches those who aren’t. There’s plenty of great starting points in this book, for those who struggle with swiping their magic credit card too often and have no clue about saving, let alone investing.

I like that the book makes room for spending on what you enjoy, and eliminating temptations by simply automating as much as possible. Whatever’s left you can spend however you want. It’s quite a funny book too, go for it!

Audio Summary

Listen to the audio of this summary with a free reading.fm account:

Who would I recommend the I Will Teach You To Be Rich summary to?

The 24 year old recent graduate, who blows all of his fancy new salary on video games and takeout, the 35 year old who sits on a pile of cash, because she’s afraid of losing the money, and anyone who blames others for being broke.

Last Updated on July 26, 2022